The whole toner versus ink cartridge conversation really boils down to this: toner is the workhorse for high-volume office printing, while ink is the specialist for high-quality color. If your office prints reams of text-heavy documents, like hundreds of invoices or training manuals, laser printers using toner cartridges will give you a much lower cost-per-page. On the other hand, for a real estate agency printing vibrant, detailed property brochures, nothing beats the quality of an inkjet printer, even if it costs more for every page you print.

When you're running a business, the choice between toner and ink isn't just about print quality. It affects your daily operational costs, long-term asset management, and even the potential resale value of your surplus supplies.

Toner cartridges are filled with a dry, stable polymer powder. Think of it as a dust that doesn't really expire. This incredible stability is why unopened OEM toner holds its value so well on the buyback market—it's a durable asset with a seriously long shelf life. For example, a box of HP 414X toner cartridges from a discontinued office printer is still a valuable asset years later because the powder inside remains perfectly viable.

Ink, however, is a liquid pigment. It’s fantastic for creating a rich, full-color marketing brochure or printing out detailed architectural plans, but that liquid is its biggest weakness. It can, and often does, dry out. This gives ink a much shorter, often date-stamped, shelf life, which puts a major dent in its liquidation value. A practical example is finding a box of Epson ink cartridges in a supply closet that are three years past their expiration date; they are likely worthless because the ink has dried out. Getting a handle on these differences is the key to both managing your printing budget and getting the most cash back for your unused assets.

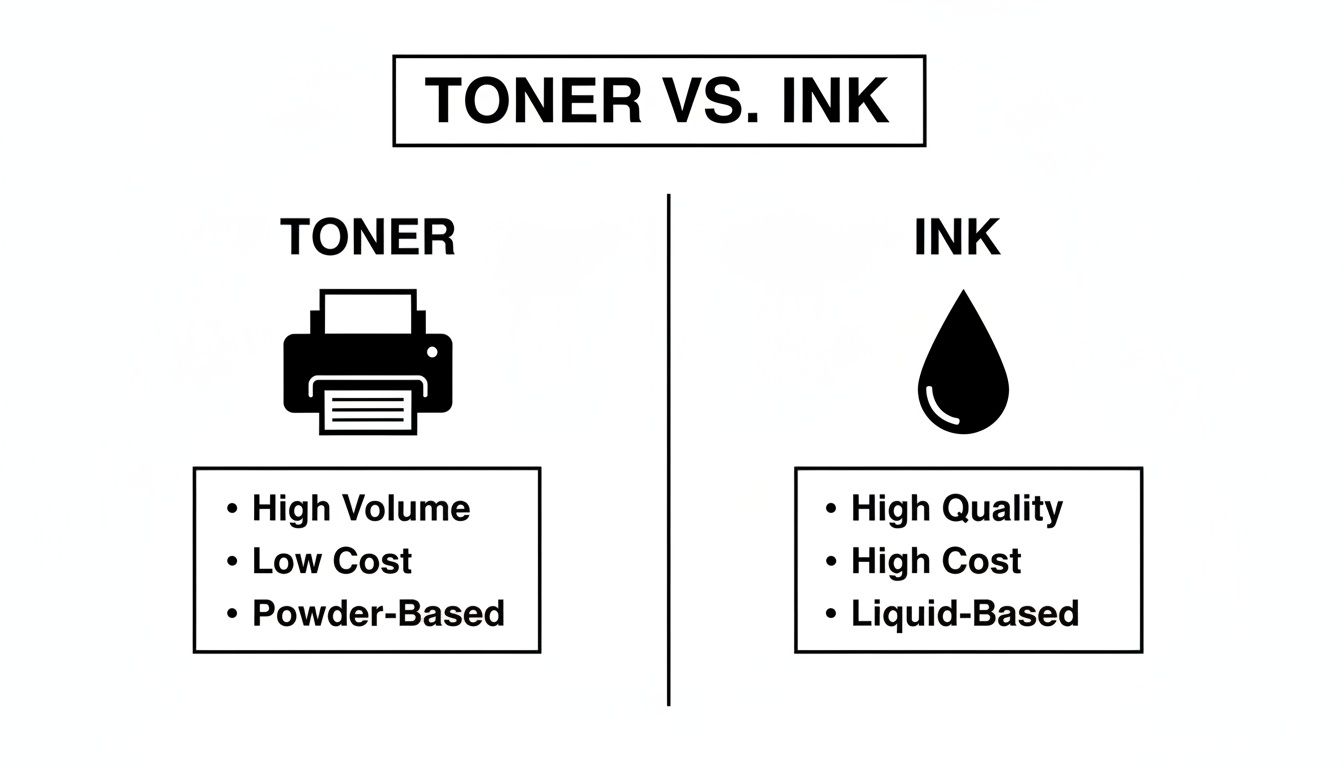

This chart gives you a quick visual breakdown of the main trade-offs.

As you can see, it's a classic balancing act: do you need high volume and low cost, or are you prioritizing top-tier quality and color?

To make a smart financial move—whether you're buying new supplies for the office or getting surplus inventory ready to sell—you need to focus on the details that really matter in a business environment. This table cuts right to the chase, comparing the crucial distinctions between the two technologies.

| Attribute | Toner Cartridge (For Laser Printers) | Ink Cartridge (For Inkjet Printers) |

|---|---|---|

| Technology | Dry polymer powder is melted and fused onto paper with heat. | Liquid ink is sprayed onto the page through microscopic nozzles. |

| Primary Use Case | Best for high-volume text documents like reports, invoices, and contracts. | Ideal for high-resolution color images, photos, and marketing materials. |

| Print Volume | High to very high page yield, often numbering in the thousands of pages. | Low to moderate page yield, typically just a few hundred pages. |

| Cost Per Page | Significantly lower, making it the go-to for large-scale office printing. | Significantly higher, which makes it better for specialized, low-volume jobs. |

| Shelf Life | Extremely long and stable. It’s a durable asset with strong resale potential. | Limited to 1-2 years. It's prone to drying out, which hurts its resale value over time. |

At the end of the day, the fundamental differences laid out here have a direct impact on your bottom line.

The most critical takeaway for anyone managing office assets is this: toner’s stability and high page yield make it a much more reliable and valuable long-term asset compared to ink. This is exactly why it commands higher prices and stronger demand in the surplus buyback market.

To really get to the bottom of the toner versus ink cartridge conversation, you have to understand how each one puts an image on paper. They are built on fundamentally different technologies, a fact that dictates everything about their performance, speed, and their value as surplus inventory. The mechanics behind each one explain everything from cost-per-page to why one lasts for years on a shelf while the other doesn't.

First, let's clear up a common misconception: toner is not a liquid. It’s an incredibly fine, dry powder made of polymer—essentially a plastic dust—mixed with pigment. Laser printers use a brilliant combination of static electricity and heat to get this powder onto a page.

This process is what makes laser printers so precise and efficient. It's the reason they can churn out page after page of sharp, black text at high speeds, a non-negotiable for most business settings.

The real magic of a laser printer happens inside, centered around its drum unit. Here’s a quick look at how that technology turns powder into a printed page:

This heat-fusion step is why pages emerge from a laser printer warm to the touch. It’s also what makes laser-printed documents so durable; the text is literally melted onto the page, making it smudge-proof and archival-quality right out of the machine.

Think about an accounting department printing a 500-page annual report. A laser printer is built for this. It will produce crisp, identical pages from start to finish without breaking a sweat. This is the exact kind of high-volume, high-speed scenario where toner's value in a business environment becomes crystal clear.

Inkjet printers work on a completely different principle. An ink cartridge is a reservoir of liquid pigments or dyes. The hero of this technology is the printhead, an intricate component packed with thousands of microscopic nozzles.

When you hit "print," the ink is either rapidly heated or zapped with an electrical charge (a piezoelectric effect), which forces tiny droplets out of those nozzles and onto the paper. The printer painstakingly sprays millions of these dots to construct an image, line by painstaking line. This method is precisely why inkjet printers are so good at blending colors.

For example, a marketing team printing a handful of vibrant, photo-heavy brochures for a trade show would reach for an inkjet. Its liquid inks blend seamlessly to create the rich gradients and photorealistic quality that makes marketing collateral pop. But this liquid nature is also ink’s biggest weakness. It can dry out, clog the printhead nozzles, and has a much shorter shelf life. This technical reality is a major reason why surplus ink often has a lower resale value than the incredibly stable, long-lasting toner.

When you're trying to figure out the real cost of toner versus ink cartridges, looking at the sticker price is a classic mistake. The number that truly matters for any business is the cost per page (CPP). This simple metric cuts through the noise and shows you the true, long-term financial reality of your printing operations.

Calculating it is easy: just divide the cartridge's price by its estimated page yield. This single figure is the reason laser printers are the workhorses of most offices. The numbers simply don't lie—toner almost always delivers a better return on investment when you're printing in any significant volume.

This fundamental economic advantage is what fuels the entire secondary market for surplus toner. Smart businesses are always looking for ways to trim operational expenses, and buying genuine OEM toner at a discount is a go-to strategy.

Let's run the numbers on a real-world business decision. An office is choosing a new printer and needs to understand the long-term supply costs. They're looking at a standard laser printer versus a high-capacity inkjet model.

Now, let's see what the cost per page looks like.

Toner: $100 / 2,500 pages = 4 cents per page

Ink: $40 / 500 pages = 8 cents per page

In this head-to-head comparison, the ink ends up costing double what the toner does for every single page printed. For a department that prints 5,000 pages a month, choosing toner would save them $200 every month ($400 for ink vs. $200 for toner). Over a year, that difference adds up to $2,400 in savings, making toner the clear winner.

This cost-per-page efficiency directly translates to the resale value of your surplus cartridges. When a business needs to liquidate unused inventory, that unopened box of high-yield OEM toner isn't just taking up space—it's a surplus asset with real value.

Because of its inherently low cost-per-page, that cartridge is a hot commodity for other businesses trying to lower their own printing costs. This creates a steady, reliable demand in the buyback market. Your surplus toner represents an opportunity for another company to get the same great printing efficiency at an even better price. For instance, a law firm upgrading its printers can sell its old, unused toner cartridges to a buyback company, which then sells them to a smaller business that still uses that printer model, saving them money.

On the other hand, while surplus ink still has some value, its higher CPP makes it less appealing as a bulk purchase for high-volume offices. The financial logic is what makes toner a much more stable and in-demand asset.

The economic gap between ink and toner gets even wider when you bring high-yield, or "XL," cartridges into the picture. Manufacturers specifically design these to drive the cost per page down for their high-volume customers.

Here’s a breakdown of how the math works out:

| Cartridge Type | Purchase Price | Page Yield | Cost Per Page (CPP) |

|---|---|---|---|

| Standard Toner | $100 | 2,500 pages | 4.0 cents |

| High-Yield Toner | $150 | 5,000 pages | 3.0 cents |

| Standard Ink | $25 | 220 pages | 11.4 cents |

| High-Yield Ink | $40 | 500 pages | 8.0 cents |

As you can see, choosing a high-yield cartridge is always the smarter financial move, dropping your CPP significantly. This is especially true for toner, which can get your operational costs down to just a few pennies per page. A practical example is a medical office that prints thousands of patient records; by exclusively using high-yield toner, they can reduce their supply costs by 25% compared to using standard cartridges.

This is exactly why surplus high-yield OEM toner cartridges are the most valuable items you can sell on the secondary market. They consistently bring in the highest offers from buyback partners like Toner Connect because they represent the absolute best value for the next business that puts them to use.

When surplus inventory is sitting in a storage room, it's either a future asset or a ticking liability. In the toner versus ink cartridge debate, shelf life is the single most important factor that decides which category your supplies fall into. The physical makeup of toner and ink creates two completely different scenarios for long-term storage and how well they hold their value.

At its core, toner is a dry polymer powder, which makes it exceptionally stable. It doesn't have liquids that can evaporate, separate, or break down in a short time. As long as a toner cartridge stays in its sealed packaging and is kept away from extreme heat and humidity, it can be perfectly usable for years—sometimes even a decade—past its manufacturing date.

This incredible stability makes surplus toner a low-risk asset for any business. It’s a durable good that holds onto its functionality and, as a result, its market value over a much, much longer timeline.

Let's look at a real-world example. An office manager finds a sealed box of five-year-old OEM toner cartridges while cleaning out a supply closet. The box is in great shape and was stored in a climate-controlled room. Despite their age, these cartridges are almost certainly as good as new.

When this manager looks for a buyback quote, the toner's age is far less of an issue than the condition of the packaging. The powder inside is still pristine, and the cartridge can be sold with confidence, getting a solid price on the secondary market. Why? Because the next user will get the same performance and page yield they would from a brand-new cartridge.

For businesses liquidating assets, toner's longevity is a huge financial advantage. Its stability gives you a wider window of opportunity to sell and a much higher chance of recouping a big chunk of your initial investment, turning forgotten inventory into cash.

Ink cartridges are a completely different story. Being a liquid, ink is naturally more volatile and prone to breaking down. Over time, several problems can make an ink cartridge totally useless, even if it's never been opened.

This built-in instability is why most ink cartridges have firm expiration dates, usually within 18 to 24 months of being made. Buyback programs have to be much stricter with ink because its usefulness is a race against the clock.

Several factors are working against ink's shelf life:

So, if that same office manager found a box of five-year-old ink cartridges, they would be worth little to nothing. A practical example is someone trying to print with an old inkjet cartridge only to find the pages are streaky or completely blank, even though the printer says the cartridge is full. This is a classic case of dried ink clogging the printhead, rendering the cartridge useless and potentially damaging the printer. This stark difference in stability is exactly why toner is a more reliable and valuable asset for businesses to manage.

It's one thing to know the technical specs of toner and ink, but the real money is made when you understand how those differences play out in the open market. When it comes to toner versus ink cartridges, demand dictates everything. Each has its own distinct buyer, creating two separate ecosystems that directly shape what your surplus inventory is actually worth.

The surplus toner market is almost entirely commercial. Businesses are the ones buying, and they're always on the hunt for ways to trim operational costs without risking printer downtime. This creates a steady, powerful demand for unopened OEM toner, especially for the workhorse laser printer models you see in every office.

Ink, on the other hand, plays in a much more fragmented field. The buyers are typically smaller offices, home-based businesses, or individual consumers. There's definitely a market, but it’s less centralized and far more unpredictable, which means resale prices can swing wildly compared to the consistent corporate appetite for toner.

Think about the businesses that live and die by their printers—law firms churning out contracts, logistics companies printing endless shipping labels, or schools printing thousands of worksheets. For them, printing is a major line item in the budget. Getting their hands on genuine OEM toner at a discount through the secondary market is a straightforward way to save serious cash.

This constant business need is what props up the entire toner buyback industry. High-yield OEM toner cartridges are the golden ticket here. They offer the best cost-per-page, making them a top priority for any smart purchasing manager. Because of this, these cartridges hold their value incredibly well and are easy to sell quickly.

While both surplus toner and ink have value, high-yield OEM toner for popular office laser printers typically commands the highest and most consistent buyback prices due to strong commercial demand and lower product volatility.

This stability makes toner a much safer inventory bet for sellers. The demand isn't tied to a season or a trend; it's a fundamental part of running a business. That ensures your surplus toner remains a valuable, liquid asset.

The numbers from the broader printer supply industry back this up. While ink cartridges might currently have the largest market share overall thanks to home printers, the commercial world tells a very different story. The commercial end-user segment is on track to dominate the ink and toner market, projected to account for a 63.1% revenue share by 2025.

This growth is being driven by sectors like finance, legal, education, and healthcare—all industries that rely on high-volume, reliable printing where laser printers are king. For a practical example, a hospital that prints thousands of patient files and billing statements daily will almost exclusively rely on a fleet of laser printers. As more businesses invest in laser technology for its efficiency, the demand for the corresponding OEM toner on the secondary market naturally grows right alongside it. If you're selling supplies, understanding competitive pricing strategies is crucial for capitalizing on these trends and maximizing your profitability.

For sellers, the surplus ink market is a trickier game to play, and a few key factors directly impact the prices a buyback partner can offer.

These issues create a market with higher risk and much lower price stability. You can still make money selling surplus ink, but you have to move fast and manage your expectations.

For businesses looking to build a reliable revenue stream from surplus supplies, the steady, predictable, and high-value nature of the commercial toner market makes it the clear winner. If you want to explore how a partnership model can help you tap into this, learn how you can work with us as a dealer.

So, you’ve sorted through your supply closet and have a handle on what’s toner and what’s ink. The next step is turning that pile of surplus supplies into actual cash. The smartest and fastest way to do this is by working with a dedicated buyback partner. It takes all the guesswork out of the process and gives you a clear path to convert those dormant assets into working capital.

To get the best possible offer, a little prep work goes a long way. Getting organized before you reach out will guarantee a faster, more accurate quote and a smooth transaction. It's a simple step that can seriously boost your payout.

Follow these quick steps to get your inventory ready for a competitive quote. This is exactly what a buyback partner needs to accurately assess the value of your items.

Once your list is good to go, you can easily submit your items for a fast quote and find out what your surplus supplies are really worth.

Picking the right buyback partner is everything. A reliable company makes the entire experience seamless, from the first contact to the final payment, with transparency and convenience at every step. Don't settle for less.

A top-tier partner will send you prepaid, insured shipping labels, so sending your items never costs you a dime. They should also provide clear, transparent pricing based on real-time market demand, so you know you're getting a fair deal. Finally, look for fast and flexible payment options—like PayPal, Zelle, or a check—that are sent out right after your items are received and inspected.

The global market for ink and toner was valued at a staggering USD 19.116 billion in 2023 and is projected to hit USD 33.703 billion by 2032. This consistent growth highlights a strong demand, which is great news for the secondary market where your surplus supplies find a new home.

This thriving market means your extra toner and ink have real, tangible value. And it's not just about cartridges. Businesses can also look into specialized IT Asset Disposition (ITAD) services to manage and recover value from their entire printing infrastructure. By working with experts, you not only get capital back but also ensure perfectly good products stay out of landfills, contributing to a more sustainable circular economy.

When you're dealing with surplus printer supplies, a few questions always seem to pop up. Here are some straightforward answers to the common queries we hear from businesses looking to manage their toner versus ink cartridge inventory.

It really comes down to quality and trust. Professional buyback companies focus on OEM (Original Equipment Manufacturer) cartridges because they offer guaranteed performance, reliability, and perfect compatibility. The businesses that buy from us expect a product that works just like it came off a retail shelf.

Once a box is opened, that guarantee is gone. For example, the cartridge could have been exposed to humidity, which can damage toner powder, or an ink cartridge could have started drying out. Remanufactured cartridges, while they have their place, don't meet the high quality standards required for the secondary market. By sticking to new, sealed OEM products, we can maintain a reliable marketplace and offer the best possible prices for your inventory.

Our best advice? Sell them as soon as you know you don't need them. Printer technology moves fast—new models come out, old ones are retired, and when that happens, the demand for their specific cartridges can plummet overnight.

This is especially true for ink cartridges, which have hard expiration dates that directly impact their value. A practical example: an ink cartridge with 18 months left before its expiration date will get a much better offer than the exact same cartridge with only 6 months left.

Waiting almost always means getting a lower return. By selling your surplus inventory now, you capture its current market value, reclaim your storage space, and turn a depreciating asset into cash.

The value of your toner and ink isn't static; it's based on real-time market conditions. We look at a few key factors: the cartridge model number, how high the current demand is, the overall supply available, and, of course, the condition of the box.

For ink, the expiration date is a huge part of the calculation. As a general rule, high-demand toner for popular office laser printers tends to fetch the highest prices. For example, toner for a widely used HP LaserJet Enterprise printer will have a higher buyback value than ink for an obscure home photo printer. We use up-to-date market data to make sure our offers are both competitive and transparent. For a deeper dive, check out our buyback program FAQ page.

Selling your surplus supplies is one of the easiest ways to make a positive environmental impact. Instead of ending up in a landfill, where they can take centuries to break down, these perfectly good cartridges get used as intended.

Think about the resources that go into making a new cartridge—from the oil used for the plastic to the energy consumed in manufacturing. By putting your unused OEM supplies back into circulation, you’re actively participating in a circular economy. For a practical example, when your office sells five unused toner cartridges, you prevent the manufacturing of five new ones, saving significant amounts of raw materials and energy. You reduce waste, conserve resources, and shrink the printing industry’s environmental footprint, all while recovering cash for your business.

Ready to turn your surplus printer supplies into cash? At Toner Connect, we make it simple to get a fast, fair quote for your unused toner and ink. With free prepaid shipping and quick, flexible payment options, you can clear out your storage and boost your bottom line.